Use this “little” formula to avoid over paying for rental properties

There is a “little” formula investors use to see if they’re buying an investment property below value. The value determined by this little formula may be different than the valued determined by studying comparable home sales. The formula is actually designed for investors and helps us to avoid overpaying when acquiring rental real estate.

To use the formula, you’ll need to know what the average market rent is for the property you’re considering. You can get an idea of what the average rental rates are with these two websites:

1. Craigslist – I always study homes listed for rent in Craigslist that are similar to the home being considered for investment. These Craigslist listing are an indication of what market rents are for similar homes. Make sure you search for similar homes in similar areas. If you’re considering a 4 bedroom home with a basement, try and find similar 4 bedroom homes with basements posted for rent. Studying these comparable rentals will help you see what the rental rate for your property might be. Here is a screenshot of a search I did for a 4 bedroom home in Willowick, Ohio:

![]()

The image may be hard to see, but the search found two 4 bedroom homes posted for rent. Both homes are offered at $1,100 per month. You can study the details of each post to see how the homes compare to the property you’re considering.

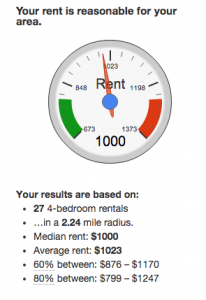

2. Rentometer.com – This website shows the average rental price for a given location. You’ll have to type in the property address and your estimated rental rate. Once you do, you’ll see a breakdown of average rents in the area. Here’s a screenshot of a search I did for the same 4 bedroom home in Willowick, Ohio:

You can see the average rent for 4 bedroom homes within this area is $1,023. Using the information from both websites, we can see the rental rate for a 4 bedroom home in Willowick is between $1,023 and $1,100 per month depending on the condition of the home.

Now that you know the monthly rental rate, lets plug it into the “little” formula:

Multiply the average rental price per month of the property you’re considering by 12 months to calculate the gross rental income. Now multiply the gross rental income by 8 and this will give you the maximum price you should ever pay for the property. A price below this maximum amount is a good value relative to the income generated by the property. A purchase price significantly below 8 times the gross annual rents is a fantastic investment.

Here’s how this formula works with our 4 bedroom home example from above:

A four bedroom home with an average monthly rental rate of $1,023 per month. Multiple $1,023 times 12 months to calculate the gross annual rents of $12,276. Multiply $12,000 by 8 to calculate maximum purchase price for the property, which is $98,208 in this example. If you can acquire a 4 bedroom home in Willowick below $98,208, you’ve found a good income investment opportunity.

The formula forces you to only consider properties that will provide you with a minimum gross rental return of 12.5% on the price paid for the home. By eliminating all properties priced above this amount, you’re locking in a great return on investment.

As I write this article, there are 21 four bedroom homes listed for sale in Willowick. Only 5 of these homes is priced below $98,208. This little formula helps streamline your search as you won’t have to waste anytime looking at other homes above this price range.

The best part about this formula is that it focuses on the income available from the property. This is significantly different than what the average investor might think about when looking for an investment property. The average investor typically focuses the price of the home without much thought about income. This thinking is a little backwards when your focus is on income.

Keep this little formula handy and you’ll save a lot of time searching for profitable properties.

Pingback: Check out these foreclosure deals… | Dividend Real Estate