Check out these foreclosure deals…

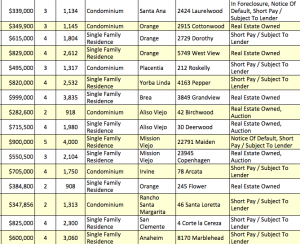

I network with many real estate agents throughout North America. One of these agents sent me a list for foreclosures for Orange County, California. Here it is:

Click on the image to enlarge.

Click on the image to enlarge.

These properties are assumed to be good deals in their market, as they are foreclosures and short sale opportunities. The lowest priced property on the list is a 3 bedroom condo with 1,134 square feet available for the low price of $339,000. This condo is available for just $298.94 a square foot! What a bargain!

I wonder what the condo association fees are per month? On the other hand, maybe I don’t.

To see how this might work as an investment, I checked average rents for this property on Rentometer.com.

The average rent for a 3 bedroom property like this one in Santa Ana is $1,828 per month. Based on our formula for investing, the maximum purchase for this property would be $175,488. This foreclosure is over priced by….um…. $163,512 ! Yikes.

How can an investor looking for income make any money buying these foreclosures?

We could buy three great investment properties here in Ohio for the amount this condo is over priced. These three great investment properties would easily provide $1,800 of monthly income after subtracting property taxes and insurance.

This makes me absolutely love Ohio and our home pricing. Yes, I know our winters aren’t fun. Yes, I know it is gray for several months of the year. Yes, I often wonder why we live in Ohio.

Despite all of this, we can easily make double digit returns annually on our real estate investments.

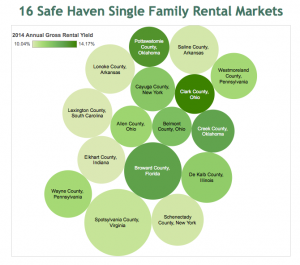

In fact, in the info graphic below from Realty Trac, you can see the best “Safe Haven” real estate investing markets throughout the country. Notice three of the sixteen “Safe Haven” markets are in Ohio:

These markets were ranked as safe haven markets based upon their study of unemployment rates, vacancy rates, and rent rates. These safe haven markets have annual gross yields on rentals in the double digits meaning investors can lock in very attractive returns based upon average the sales price.

These markets were ranked as safe haven markets based upon their study of unemployment rates, vacancy rates, and rent rates. These safe haven markets have annual gross yields on rentals in the double digits meaning investors can lock in very attractive returns based upon average the sales price.

The best part about these double digit yields is that they are locked in going forward and investors can compound this high income into other investments with each passing year. You can read the full Realty Trac article and watch a short video of this study on their page here:

Although we don’t live in a specific county identified by the Realty Trac study, our market is similar. We are able to lock in double-digit returns with properties in Lake County, Ohio. In fact, the pricing on some of the best homes I’ve identified is lower than it was in the early 1990s.

If you would like to receive email updates of the best income properties on the market, you can signup for free here.