The 7 Income Streams of Millionaires (According to the IRS)

According to the IRS, most millionaires have these seven income streams:

1. Dividend income from stocks owned.

2. Earned income from a paychecks.

3. Rents from rental real estate.

4. Royalties from selling rights to use something they’ve written or invented.

5. Capital gains from selling appreciated assets.

6. Profits from businesses they own.

7. Interest from savings, CDs, bonds, or other lending activities.

I’m personally not interested in the “millionaire” status. Paper wealth is (for the most part) meaningless. It doesn’t change your life in any meaningful way. You can’t eat paper wealth.

I am, however, extremely interested in the income streams of millionaires and found this summary to be interesting. Of the seven income streams, I’m personally only interested in pursuing five of them. I have zero interest whatsoever in these two income streams:

1. Earned income from a paycheck.

2. Capital gains from selling appreciated assets.

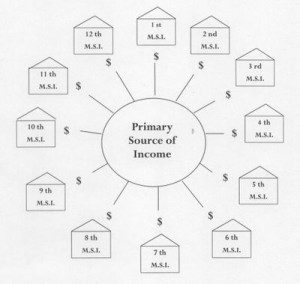

This leaves five basic income streams to study, pursue, and possibly create. The order in which you create these various income streams dictates the ultimate success you’ll enjoy.

Most people focus on three of these income streams: earned income, interest income, and dividend income.

They spend the majority of their time earning a paycheck. This paycheck is limited by the number of hours of their life they’re willing to trade away. In addition to this time limitation, there is another expense they incur. This expense is the opportunity cost of the time lost at work. Instead of building new income streams, they continue working on their existing limited income stream: paycheck.

If these same people do create additional income streams, they’ll typically choose the two income streams offering the lowest income: dividend income (stocks) and interest income (bonds) These income streams will come from their contributions into their 401k plans.

In my humble opinion, rental income is the single most important income stream. This income stream should be our #1 priority. The main reason why is because it has the potential to reduce your need for earned income. Once you have enough rental income to walk away from your job, you now have TIME. TIME is the most important asset we have and you can now leverage your TIME to create new income streams.

You can start a new business.

You can create websites.

You can write a book.

You can invent cool stuff.

You invest your rents into dividend stocks.

You can invest your rents into bonds, CDs, etc.

You can invest your rents into other small businesses.

You can continue investing in rental real estate.

By focusing on rental income as our primary income stream, you unlock the doors to all other income streams. This same opportunity does not exist when we focus our time on earned income, dividend income, and interest income.

Pingback: 2019: Everything in Balance - Fareed Behardien

Pingback: How to Get Rich ⇒ 9 Habits of the Rich - I Want Lots of Cash

Pingback: What Pandemics Teach Us About Multiple Income Streams - Quiet Income

Pingback: The Wealthy Have Multiple Streams Of Income – How Many Do You Need?

Pingback: 3 Steps to Achieve Financial Independence | Aventine Financial Group

Pingback: How To Get Rich From Nothing – Titre du site

Pingback: Financial Goals - How to set your Money goals - ProjectGirl2Woman

Pingback: How To Become A Millionaire With No Money Online - ObizTools.com

Pingback: The 4 Simple Secrets of the Wealthy - Find Your Flourish Coaching

Pingback: 3 New Money Habits You Should Start Today - Find Your Flourish Coaching

Pingback: Side Hustle Survival Guide