Triple Compounding

On this site, I often highlight the magic of compound interest. Compounding occurs when your money makes more money for you. Your money goes to work to bring back more money for you and your family.

Well, once you truly grasp the magical power of compounding, you’ll probably start to look for ways to maximize your compounding. Believe or or not, you can setup a system where you enjoy the benefits of triple compounding.

1. Acquire A Cash Generating Asset That Provides Monthly Income

The monthly income suggested in this step IS important because it allows you to reinvest faster accelerating the compounding. There are many assets that provide monthly income. In this example, I’ll highlight a 4 unit property for sale in Fairport Harbor.

As I write this article, this home is listed for sale at $150,000. The total monthly income from the four units is $2,300. According to the seller’s numbers, the monthly expenses average $700 per month providing $1,600 a month of income. If you acquired this four family investment property, your $150,000 investment would now be proving $1,600 a month of income. This is your first level of compounding as your money is now earning around 12.8%. ($19,200 of income divided by $150,000 invested.)

2. Reinvest this monthly income into a high-quality dividend stock with a history of raising its dividend each year.

In step two, we’re going to use the monthly income from our four-family property to acquire high quality dividend stock. The key part of this step is to focus on companies that have a long history of raising the dividends they pay to shareholders.

A few of the companies that meet this criteria might be Johnson & Johnson, Colgate-Palmolive, 3M Company, General Mills, or Parker-Hannifin. After you collect your rents and pay the expenses for the four family property, you’ll take your monthly cashflow of $1,600 and use it to acquire more shares of high-quality dividend paying stock. When you make your stock investment, be sure to check the box to automatically reinvest the dividends.

Now you’ve added the second layer of compounding as your $1,600 of income starts to generate dividend income. If you were to purchase $1,600 of General Mills stock each month, you would add an additional 3.20% to your return on investment. This is the dividend currently paid by General Mills. This dividend is paid quarterly. Your $150,000 is now earning you 15.8% through the double compounding. Your first 12.8% comes from the rental income and your second 3.2% comes from the General Mills stock.

3. Your third layer of compounding starts when the quarterly General Mills dividend is paid because you’re automatically reinvesting this dividend into additional shares of General Mills stock. These additional shares were paid for by the General Mills dividends and will add another 3.2% to your return. The reason why these additional shares of General Mills will add another 3.2% to your return is because you’ll start receiving dividends on these added shares.

Within a few short months, your $150,000 investment will be:

1. Providing you with monthly rental income averaging 12.8%.

2. The General Mills stock will provide you with dividends averaging 3.2%

3. Your General Mills stock will buy you additional shares of General Mills stock paying you an extra 3.2%.

Every quarterly dividend payment you collect from General Mills will be larger. This happens because you’re purchasing $1,600 of shares each month increasing your ownership position through the monthly rental income. This acceleration continues as the General Mills dividends acquire even more shares for you with the automatic dividend reinvestment.

But wait… it gets better!

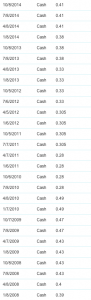

General Mills has a long history of annual dividend increases. Back in 2001, General Mills paid $1.10 for each share owned. Today, General Mills pays around $1.64 for each share owned. Here’s a look at the growth of the General Mills dividend since 2008:

You can click the image to enlarge.

Notice how the dividend increases each year? This another reason every dividend you receive from General Mills will be higher. You’ll be accumulating more shares each year and the dividend paid will be higher with each passing year.

Some might consider these annual dividend increases to be a fourth layer of compounding!

Note: If you’re into this compounding thing like I am, you might check out this paper:

http://staging.americanindependence.com/wp/wp-content/uploads/2014/07/Div_Growth_White_Paper_AI_7-12-14.pdf

It is a special report showing the power of increasing dividends and automatic dividend reinvestment.