How to Use Dividend Real Estate to Pay for College Education

For many with children, college is a major expense we have looming over our heads. According to Collegedata.com:

“The cost for one year of tuition and fees varies widely among colleges. According to the College Board, the average cost of tuition and fees for the 2013–2014 school year was $30,094 at private colleges, $8,893 for state residents at public colleges, and $22,203 for out-of-state residents attending public universities.

“The College Board reports that the average cost of room and board in 2013–2014 ranged from $9,500 at four-year public schools to $10,830 at private schools.

“The College Board reports the average cost for books and supplies for the 2013-2014 school year was $1,207 at public colleges and $1,253 at private colleges.”

Combining tuition, room/board fees, and books, we are looking at $19,600 annually for a public school and $34,286 for a private school. If we’re lucky and they complete their degree in just four years, our grand totals will be $78,400 for a public school and $137,144 for a private school.

Multiply these figures by the number of children you have and you’ll have an idea of what college will cost in total for your family.

The mainstream financial community would suggest saving these amounts in a college savings account monthly and then using the funds saved to cover the related education costs in the college years.

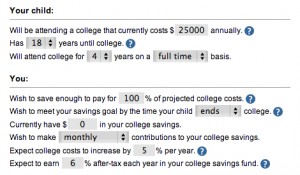

To get an idea of what we would have to save monthly, I used an online calculator with the following assumptions:

After clicking the “Calculate” button, the calculator recommended saving $561 each month. This savings rate over 18 years would provide the funds needed to cover the full cost of college for one child. Multiply this by the number of children you have.

The idea is this investment in our children will provide them with strong financial returns for the rest of their lives, as they’ll earn more in their career with their college degree.

The problem is we don’t receive any financial return on this investment. We save $561 a month for 18 years and never see a penny back from this investment? Sure, seeing our kids prosper is priceless and I’m not trying to suggest otherwise.

What I might suggest is to buy dividend real estate and use the income generated to offset the cost of college.

Instead of saving $561 per month for each child you have, why not buy a nice single family home structuring the mortgage payoff to coincide with the college years?

Let’s assume you buy a single family home and use this home to help fund your child’s college education. You obtain an $80,000 mortgage on this home at 6%. You can have this home paid off in full in 18 years with a monthly payment of $606.53. Add $200 of monthly taxes and insurance to this mortgage payment and your total monthly payment is $806.53.

Rent this home out at $850 per month and in 18 years, you’re single-family home will be paid off and will be mortgage free. At this point in time, you’ll have two options:

1. Sell the home and use the proceeds to pay for college.

2. Keep the home and use the debt-free rental income to offset college expenses. You would have $606.53 each month or $7,272 annually from this property to use towards college expenses. This amount wouldn’t cover the annual college costs. However, your child could obtain student loans and you can have these loans repaid after college with the rental income generated from this asset. The asset would continue providing income for you year-after-year.

This approach does require a lot more work over the 18 years as you’ll have to manage this property. However, you’ll be saving $561 a month or $6,732 annually – FOR 18 YEARS.

Pingback: Lessons from My Mentor’s Divorce | Dividend Real Estate

Pingback: NEEDING Money | Dividend Real Estate

Pingback: Saving for Lilly’s College Education | Dividend Real Estate