How to Make Thy Assets Multiply

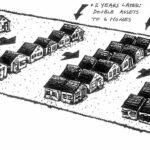

My main financial goal is to multiply income-producing assets. Many years ago, Robert Kiyosaki taught us the best definition of an asset. “An asset is something that puts money in your pocket… an asset pays you for owning it.” To increase your monthly cashflow, you must increase your ownership of income producing assets. The easiest…

Read more