How To Get Others To Save a Million Dollars For You

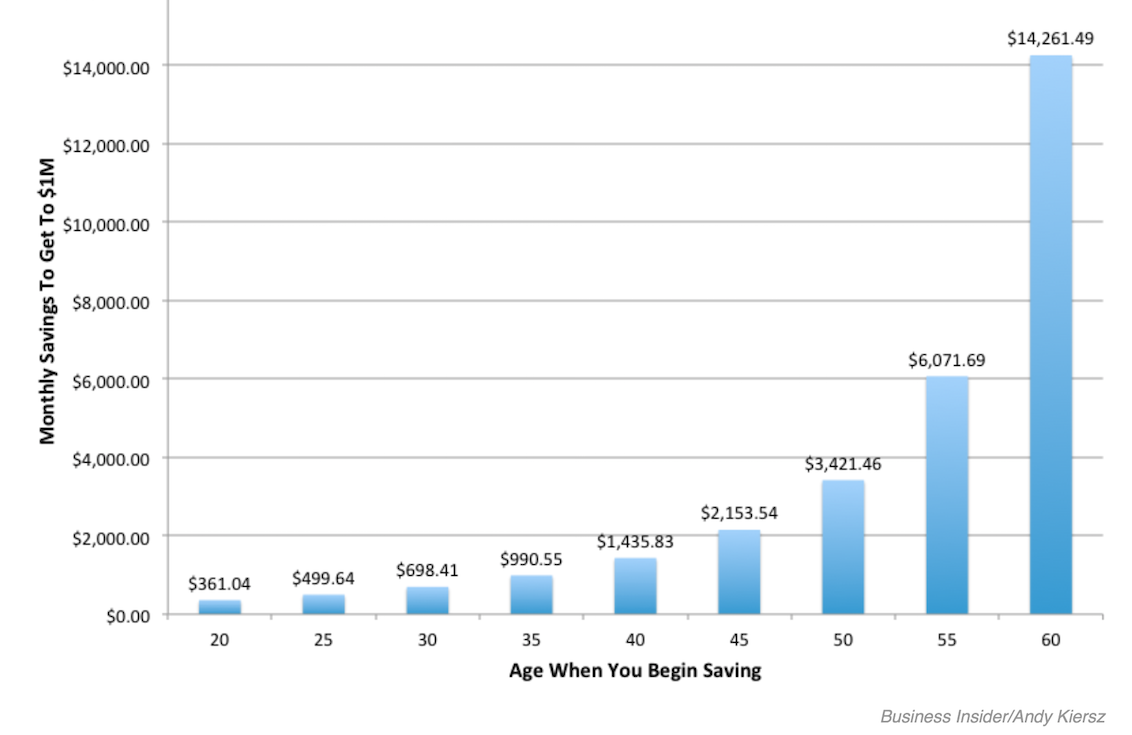

This morning I was reading an interesting article on BusinessInsider.com about compound interest when saw this graph:

(Click the picture to enlarge)

(Click the picture to enlarge)

This chart shows how much a person would have to save at various ages in order to accumulate $1,000,000 by the age of 65. Each monthly savings amount was calculated assuming you would earn 6% and this return would compound over time. It is easy to see how magical compounding is over time. Someone who is 30 years old can have a million dollars at age 65 by saving just $698.41 per month.

Pretty cool, don’t you think?

It gets better when you realize you don’t have to be the one saving $698.41 per month. You can acquire an asset that would pay you this much each month instead. You can have this income invested on your behalf and go about your life not worrying about money. Over time, the invested income from this asset will compound into $1,000,000.

The average person would make it a goal to save $698.41 out of their monthly paychecks. To accumulate $1,000,000 they would need to save $698.41 for 420 months (35 years) totaling $293,332 out of pocket.

The investor who truly understands compound interest would focus on saving enough to buy an asset that would provide the same monthly income. Once this income was flowing to the investor, they wouldn’t have to save the $698.41 out of pocket anymore. They would simply have to reinvest the income received at 6%.

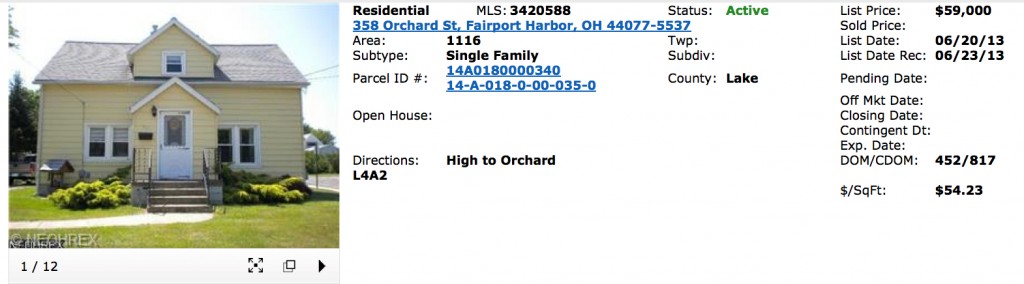

As an example, the investor could save until they’ve accumulated $65,000. They could use this savings to acquire a home like this for cash:

The tenant in this home would go to work each week to send this investor a rent check of $1,000 per month. After paying taxes and insurance, the investor could use the remainder of this rental income as a contribution to his or her $1,000,000 fund. This one asset would then provide the monthly income needed to accumulate $1,000,000.

The tenant in this home would go to work each week to send this investor a rent check of $1,000 per month. After paying taxes and insurance, the investor could use the remainder of this rental income as a contribution to his or her $1,000,000 fund. This one asset would then provide the monthly income needed to accumulate $1,000,000.

The investor who understands compound interest would no longer need to save $698.41 per month as the family living in their asset would do this for them. They would have to manage this debt-free home instead. The average person would have to save $293,332 out of pocket. The investor who understands compound interest will only have to save $65,000, which is $228,332 less.

Now I realize many people don’t want to be a landlord. They don’t want to have to manage a rental property. “I don’t want to have deal with clogged toilets!” Believe me… I don’t want to deal with clogged toilets either. However, is dealing with a few clogged toilets worth it if the family using those toilets is saving $1,000,000 for you?