How to Get a Four Year College Degree for Just $20,000

College can become one of our largest expenses as parents. This expenses escalates significantly with each child we have.

As an example, the tuition and board for a in-state college in our area will probably average around $20,000 a year. If our child graduates in four years, this investment will total $80,000 upon graduation. Now multiply $80,000 times the number of children you have and you’ll see the low range of what college will cost.

A degree at a private college will probably cost between $40,000 and $50,000 a year costing you around $200,000 per child. Crazy.

One of the activities I enjoy is trying to figure out how to buy an asset to pay for the things I want. This process involves reverse engineering the cost and then brain storming different ideas on how to accomplish the goal. Let’s walk through this process together so you can see what I do.

For this process, I’m going to use Kent State University. This is the college my wife and I graduated from. Go Flashes!

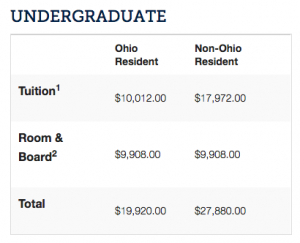

The total annual cost for an undergraduate degree at Kent State University is $19,920 totaling around $80,000 for four years. How can someone accumulate $80,000 to pay for this education without having to take on student loans?

The total annual cost for an undergraduate degree at Kent State University is $19,920 totaling around $80,000 for four years. How can someone accumulate $80,000 to pay for this education without having to take on student loans?

You can setup a savings account for your child and deposit $418 a month into this account for 10 years. If you average 9% annual returns on in this account during these 10 years, you’ll accumulate $81,495. To accomplish this goal, you’ll have to make 120 deposits of $418 into your child’s account. This will total $50,160 out of your pocket over the 120 months.

This is the process most parents would try to use. They may save more, or less, each month for college, but the idea is to save the total amount needed out of their pay checks.

Another option would be to buy an asset that provides attractive monthly income. Use the monthly income as the monthly college savings vehicle freeing up your pay check for other purposes. For this, we’ll use the example of buying a mobile home as an investment.

This picture is of a doublewide mobile home I purchased in my youngest daughter’s college savings account a year ago. This is a pretty nice home featuring 3 bedrooms, 2 bathrooms, a family room, living room and a fireplace. We invested $20,000 of her college savings to buy this home for cash. She was 10 years old and in 5th grade at the time of this purchase.

This mobile home was then sold to a buyer with an installment loan. The sale price to the buyer was $30,000. They paid a $500 down payment and financed the balance at 11.75% for 10 years. Their monthly principal and interest payment for this home is $418.99. It is hard for a buyer to get financing for a used mobile home because most lenders won’t provide this financing. This creates an opportunity for an investor to acquire a home and then finance the sale for the buyer. You can typically buy the home at a lower price because you’re paying cash and then sell the home at a slightly higher price because you’re financing the sale. This is what we did with her college savings.

The buyer’s payment of $418 per month for 10 years should look familiar! This is what I determined we would need to save each month for 10 years in order to have $80,000 for a four year college degree at Kent State University.

Here’s how this looks:

The $418 monthly payment received from this home will be invested into low cost small cap index fund. If this fund averages 9% over the 10 year period, the account will grow to around $81,000.

My timing for this plan was a little off because she only had 7 years until her high school graduation. This is three years less than the 10 years needed. So she’ll have 3 years of $5,016 flowing to her account during her first 3 years of college from the monthly payments collected on this home. This income will simply be used to help with the college expenses and will not be reinvested into the low-cost small cap index fund.

Instead of saving $418 out of our pockets for 10 years, we’ve setup a plan to generate this monthly income. This plan will bring our out of pocket cost for college down from $50,160 (determined above) to just $20,000. We’ll use the $20,000 to buy an asset and then allow the asset to pay for her college education.

The key to this idea is to reverse engineer the cost and determine the monthly savings amount needed. Once you have this monthly savings amount, the goal is to buy an asset that would provide this monthly income.

You might be wondering where the $20,000 for the mobile home investment came from? You basically have two options to accumulate this $20,000.

1. You can start saving for your child out of your income. To have $20,000 by the time your child is 8-years old, you would have to save $2,500 per year, or $208 per month. Once your child has $20,000 in their account, start looking for a home you can purchase for cash.

2. You can acquire a rental property that has a minimum monthly cashflow of $208 per month after all expenses. This income can then be deposited into your child’s college savings account. After 8 years, the tenants in this rental property will have provided $20,000 that can be used to buy a similar mobile home. This is actually the plan I used, and if all goes as planned, the entire cost of her college education will be covered through these properties.

The basic idea is to always try and buy an asset with your dollars. Use the income from the asset to pay for the things you want.

You can read more about this idea here and you’ll see how to get everything you want in life for free.