99.1% of Buffett’s Wealth Came After His 53rd Birthday

Last year, I read an article on Business Insider that indicated that 99.1% of Warren Buffett’s wealth came after his 50th birthday. I have thought about this several times since reading the article and decided to look into it a little further myself.

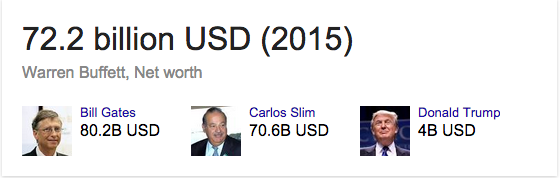

According to a recent Google search, Buffett’s net worth is currently estimated at $72.2 billion. In this article showing the evolution of Warren Buffett’s career, I found the following:

When Buffett was 53 years old, his net worth was estimated at $620 million. This means 99.1% of his wealth came after the age of 53. At the age of 59, his net worth was estimated at $3.8 billion. This means 94.7% of his wealth came after the age of 59.

Buffett is 84 years old and bought his first stock at the age of 11. He has been investing for 73 years and the majority (94.5%) of his wealth has come in the last 25 years.

This is exactly how compound interest works. It starts out slowly but increases dramatically over long periods of time. It took 42 years from the age of 11 to the age of 53 for Buffett’s wealth to accumulate a net worth of 620 million. 42 years of compounding is extremely powerful. He continued investing and compounding his returns and over the next 31 years his wealth grew by another $71 billion.

All combined, Buffett has allowed his investments to compound for 73 years.

Magic truly happens over 7 decades. Obviously Buffett is one of the best investors in the world and these numbers and his accomplishments are simply amazing. The good news is we don’t have to be the best investors in the world to benefit from the magic of compound interest.

We can put the magic of compound interest to work for ourselves just like he did. Sure, we may not compound our savings as the same rates he has achieved, but we really don’t need to in order to become wealthy.

Here’s all you will need to do:

1. Invest your savings to generate an attractive income.

2. Reinvest this income into new income producing assets.

3. Repeat… for one to two decades.

You won’t have $72 billion, but you’ll have plenty.